Mileage tracking made easy

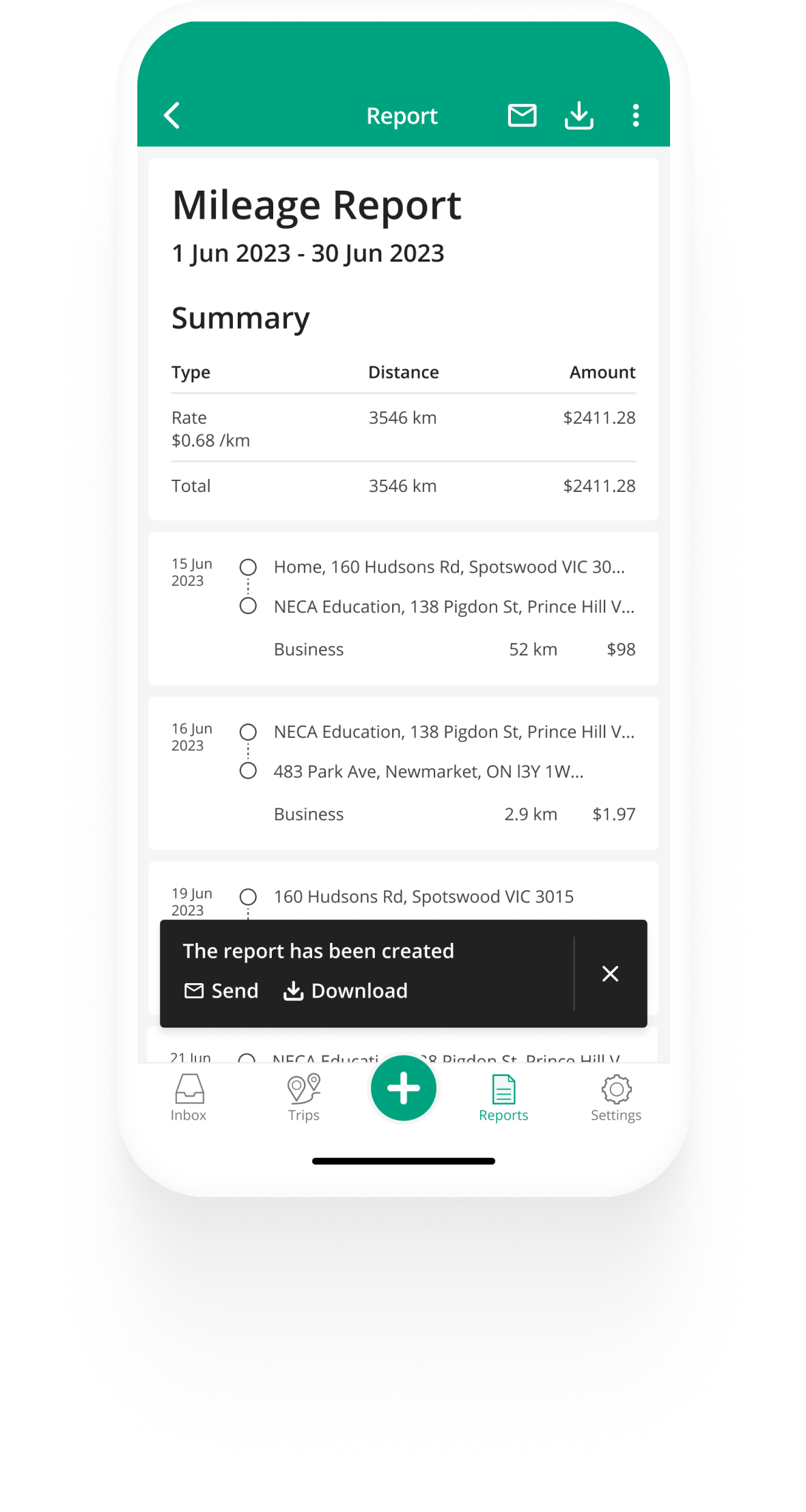

Easy and automated trip logging. Accurate and CRA compliant mileage reports. All you need is your phone, and you’re good to go.

Trusted by millions of users

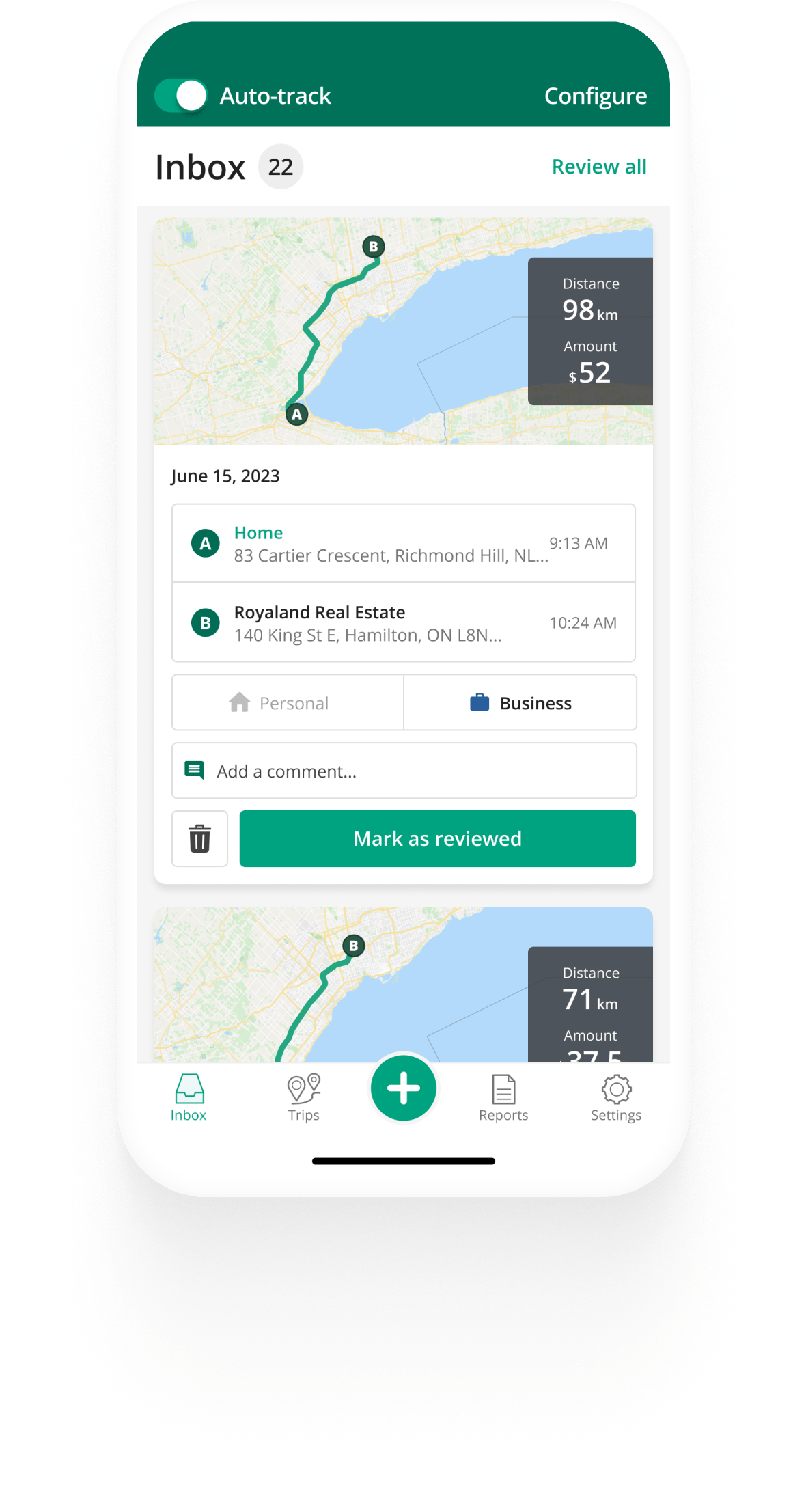

Auto-track

Track trips from your pocket

With Driversnote as your automatic mileage tracker, you can record trips without even opening the app. The motion detector lets you auto-track trips - all you have to do is drive. And if you forget to track, you can easily create manual trips later.

Read more Sign upWhat our customers say about us

Excellent app, excellent reports and excellent customer service from the team. Very highly recommended!

This app makes tax time easy! Driversnote creates the perfect report to submit to your accountant with all required information and the latest per kilometre rate. Automatic tracking takes the stress out of separating business from personal trips

Absolutely brilliant app. Never had any issues with the Tax department since using DriversNote. Very helpful support staff and an all around great company to deal with.

Seems to be doing a great job of producing a human readable (and spreadsheet exportable) log of my driving, with minimal effort. Thank you for the well designed tool!

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Seems to be doing a great job of producing a human readable (and spreadsheet exportable) log of my driving, with minimal effort. Thank you for the well designed tool!

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

Simple and easy to use. It takes "it just works" seriously.

looking good so far. auto tracking seems to work well, will turn on pro.features in a week

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

Simple and easy to use. It takes "it just works" seriously.

looking good so far. auto tracking seems to work well, will turn on pro.features in a week

The features that make mileage tracking less of a pain

Create locations

Track your trips faster by saving frequently visited places.

Multiple vehicles

Track mileage and keep separate logs for multiple vehicles.

Multiple Workplaces

Track mileage and keep separate logs for multiple workplaces.

Work Hours

Set your work hours and let the app categorize your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

Custom Mileage Rates

Customize your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Work Hours

Set your work hours and let the app categorize your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

Custom Mileage Rates

Customize your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.

Top posts

Small Business Tax Guide

Latest update: June 13, 2024 - 2 min read

We help you navigate tax as a small business owner or sole proprietor. See lists of deductions and get tips on each, including how to claim them.

Find the Best Mileage Tracking App for iPhone and Android

Latest update: October 21, 2025 - 5 min read

You can save a lot of money and maximize your tax deductions by implementing a reliable mileage tracking app into your routine.

Mileage Log Requirements

Latest update: January 16, 2026 - 2 min read

Depending on your circumstances, there may be different legal or non-legal criteria for keeping a record of your vehicle expenses in the...

Frequently Asked Questions

Use our mileage tracker app to record your business driving for employee reimbursement or tax deduction purposes. After a simple sign up, turn on Auto Tracking and you’re all set! All you need is to have your phone with you. The next time you drive, the Driversnote mileage tracker will automatically record your trips with all the required information for your reimbursement or deductions. You can easily get an overview of your trips, and create CRA-compliant reports of your mileage.

Yes! You can create multiple vehicles in the mileage tracker app and record mileage and odometer readings for each of them separately. Then, you can easily create reports of your driving for your employer or the CRA for each vehicle. If you have multiple workplaces, you can create them too and log mileage separately for each of them.

Our mileage tracker app detects who you visited and suggests your trips’ purpose which you can easily correct. Set your working hours in the app and each trip will be automatically categorised as Business or Personal according to the time of day it was recorded.